UDR ESG — Elevated Excellence

Our Commitment to Environmental, Social, and Governance Responsibilities

At UDR, we understand the impact our business can have on the environment and upon our stakeholders. Our Environmental (“E”), Social (“S”), and Governance (“G”) (collectively “ESG”) efforts assist us in identifying and managing our sustainability risks and opportunities. Our ESG improvements are designed to improve operational quality, improve associate and resident retention, and reduce our impact on the environment.

The 2023 ESG Report demonstrates our work in environmental sustainability, our investments in our associates, our residents, and the communities in which we operate, and our dedication to sound corporate governance. We are constantly working towards elevated excellence in ESG as it relates to our stakeholders and our bottom line.

For any questions about ESG at UDR, please contact UDR’s ESG Team at [email protected]

Download the Full ReportAwards

Newsweek America's Most Responsible Companies

2024, 2023, 2022

GRESB Awards

Sector Leader: 2023, 2021

5-Star Rating: 2022

Logical Buildings Smart Buildings Innovator of the Year

2021, 2020

NAA Awards

2020 Excellence in Technology & Innovation Award

2020 Silver Sustainable Living Innovation Award

In the News

UDR Achieves GRESB 5 Star Rating

2021 GRESB Top Listed Residential Company - Score 86

Other Reports

ESG Reports

2022, 2021, 2020, 2019

Environmental Metrics and Independent Assurance Statements

2023, 2022, 2021, 2020

Named a GRESB Sector Leader and first in peer group in 2023

Aligned with 10 UN Sustainable Development Goals ("SDGs")

Adopted Scope 1 & 2 emissions intensity reduction of 40% and a Scope 3 emissions intensity reduction of 30% from 2020-2035

Diversity, equity, and inclusion (“DEI”) metrics are included in our senior executive team’s short-term incentive (“STI”) program

Achieved an “A” rating on our GRESB Public Disclosure for the fifth consecutive year

On-site solar generation has generated a cumulative 3.9 million kilowatt hours (“kWh”) of renewable energy since 2019

Committed $20 million to climate and sustainability funds

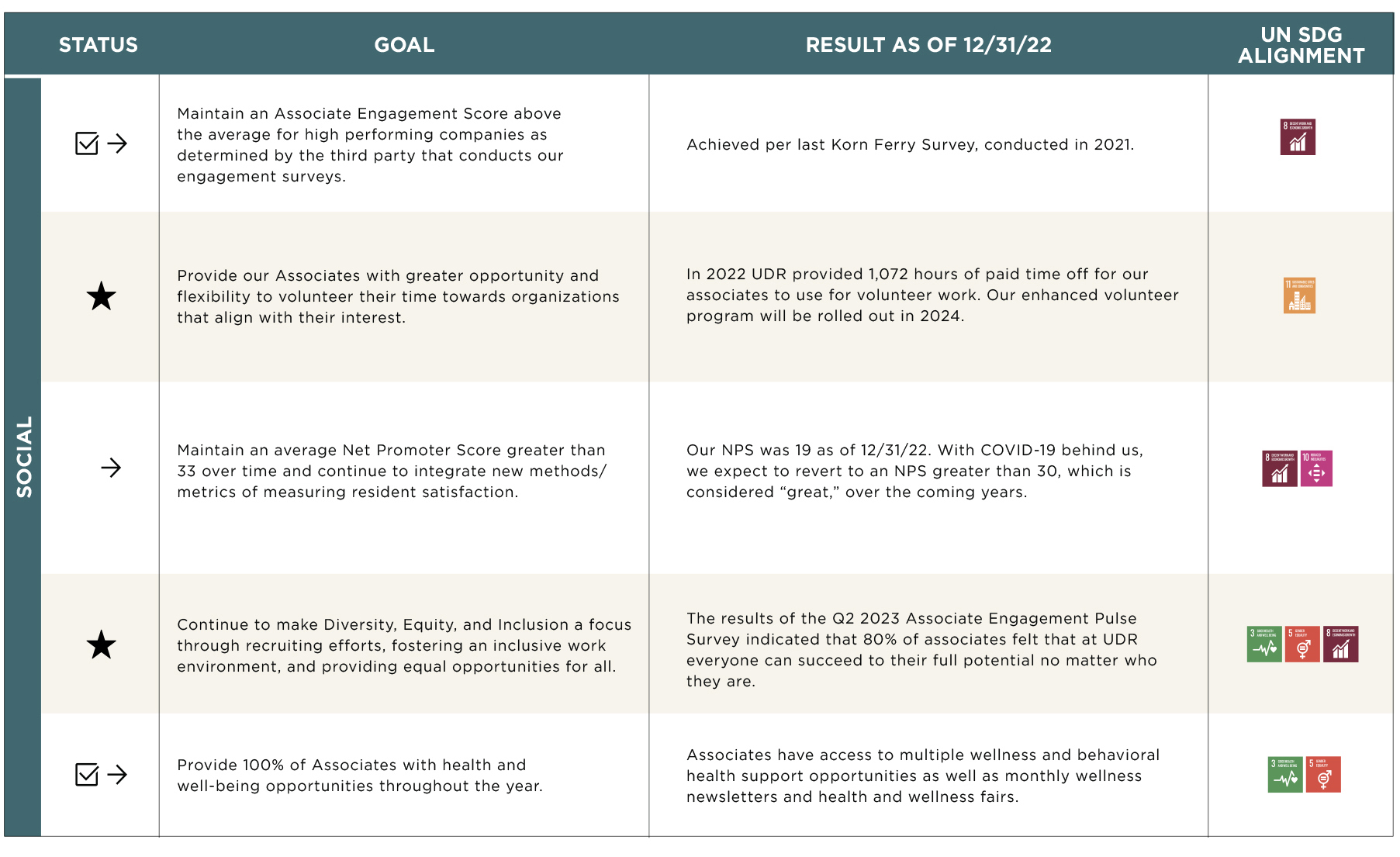

Quarterly associate pulse surveys to assess engagement, benefits, and more

UDR’s Environmental Management System (“EMS”) is certified to the ISO 14001 standard

of associates at UDR feel they can succeed to their full potential, no matter who they are

Interactions with our shareholders in 2022 and early 2023, representing 80% of common stock outstanding

of Common Area Electric Consumption procured from Renewable Energy Sources

UDR ESG Methodology

Materiality Assessment

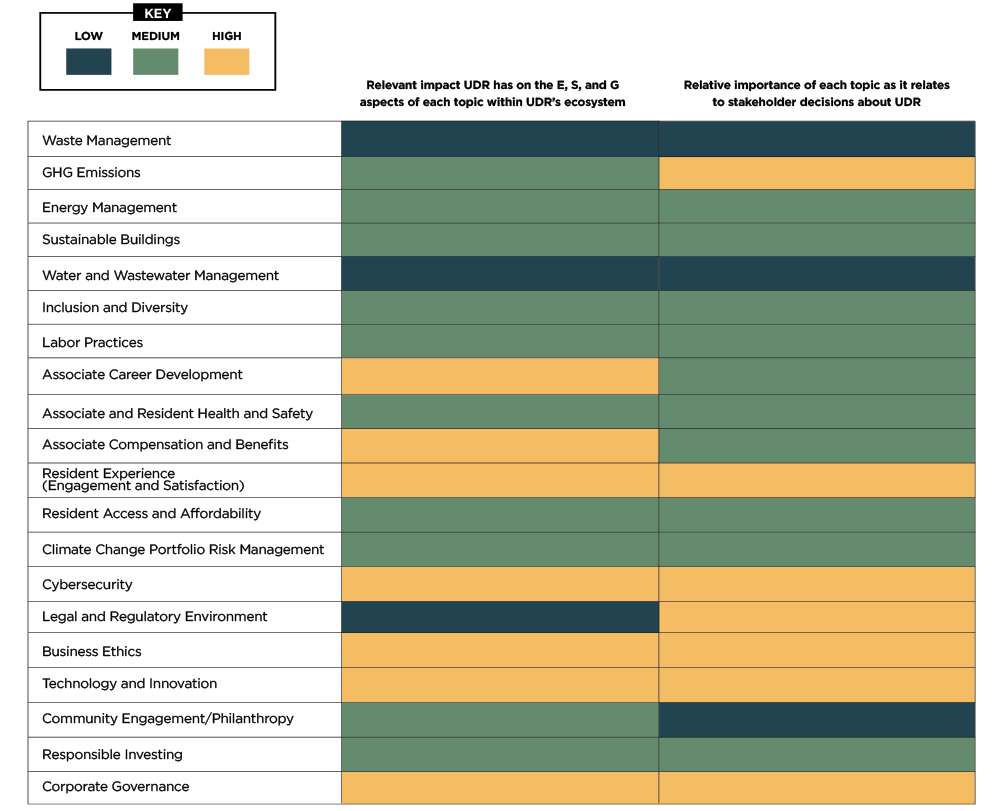

To prioritize ESG topics to include in our disclosures, we rank each topic in terms of relative significance of how each topic influences stakeholder decisions and the relevant impact UDR has on the economic, environmental, and social aspects of each topic within UDR’s ecosystem. The topics and their rankings are periodically reviewed by senior leadership through a survey to reflect current ESG initiatives and relevant ESG engagement across our stakeholder groups. The results of our most recent survey are shown in our Materiality Assessment Table.

In 2023, we added one new topic: Associate Compensation and Benefits. This topic captures UDR’s ability to offer equitable and competitive compensation and a comprehensive selection of benefits to retain top talent.

With regards to our ESG reporting, any use of the terms “material,” “materiality,” “immaterial,” “substantive,” “significant” and other similar terminology refers to the expected significance of our potential impact on economic, environmental and social topics or to topics or standards designated as “material” or “substantive” under the GRI standards, SASB standards or TCFD framework. These terms as used in our ESG reporting are not used, or intended to be construed, as they have been defined by or construed in accordance with the securities laws or any other laws of the United States or any other jurisdiction, or as these terms are used in the context of financial statements and financial reporting.

ESG Governance

In 2020, our Governance Committee Charter was amended to assign the Governance Committee oversight of the Company’s disclosures of ESG matters, including any ESG report that is published. Sustainability is incorporated into UDR’s overall risk assessments, and the Board provides risk oversight. Recent ESG discussions during Board meetings have focused on how we can further integrate human capital into our overall business and still-evolving ESG strategy as well as a refresh of our long-term Sustainability Strategy. These discussions will continue to evolve as we seek to enhance our commitment to ESG and further align the Company’s sustainability objectives with those of our stakeholders. UDR’s ESG Committee, made up of senior officers at the Company, sets Company-wide ESG targets, goals, and strategy. Chairman and CEO, Tom Toomey, steers the Committee which approves the ESG strategy, while UDR’s other members are responsible for implementing and monitoring progress towards meeting ESG targets and goals, evaluating the integrity of the Company’s overall ESG reporting processes, and assessing the vision of our sustainability objectives. As part of EMS process and our ongoing commitment to stakeholders, we conduct third-party and internal assurance testing of the accuracy and completeness of significant ESG metrics. These include GHG emissions, energy usage, water usage, waste diversion, associate compensation, diversity, training, and gender metrics included in our 2023 ESG report and the 2023 GRESB survey.

United Nations Sustainable Development Goals

In our 2022 ESG Report, UDR announced the alignment of our ESG goals with 10 of the 17 United Nations SDGs that we believe are the most relevant to our industry. To illustrate our continued commitment to these 10 goals, we have listed examples of contributions towards each selected goal with additional information available in our 2023 ESG Report.

In 2022, we introduced a Lifestyle Spending Account, a new Associate Resource Program that provides mental, emotional, and financial health resources and a Roth 401(k) retirement plan. These are in addition to our health benefit plans and traditional 401(k) retirement plan.

UDR incorporates gender-based compensation ratios into our annual compensation analysis, and the ratios as well as promotion metrics by gender are included in our ESG disclosures to provide transparency and track our efforts on this matter over time.

UDR continues to utilize water management and leak detection technology. In 2022, we used over 22,700,000 gallons of reclaimed water for irrigation purposes, thereby reducing our use of potable water.

In 2022, UDR produced over 1.6 million kWh of renewable energy through onsite solar and retired Green-e certified renewable energy credits (“RECs”) representing 31,931,000 kWh of energy usage. We continue to evaluate opportunities to implement renewable energy technologies.

In 2023, we expanded our already robust S governance framework with the addition of Shezelle Krei, Vice President of Organizational Development.

Over the last eight years we have completed over 270 sustainability projects to promote more efficient water and energy consumption and more sustainable waste management. We also have invested in strategic ESG and Climate Technology Funds, with $20 million committed to help us identify real estate technologies intended to reduce our carbon footprint.

In 2022, we conducted a compensation analysis to measure whether pay was equitable across our associate base and adjusted compensation to reflect our findings and revised our “Health of the Workforce” metric for senior leadership’s STI Program to help ensure that we are consistently sourcing a diversified field of candidates.

In 2022, UDR obtained 4 sustainability certifications, increasing our total number of certified communities to 29 (representing over 15% of the portfolio). Additionally, our environmental goal related to sustainability certification set a minimum standard of LEED Silver or equivalent for new developments.

Throughout 2022, UDR continued to engage with our residents around sustainable consumption strategies with over 149,000 environmental communications.

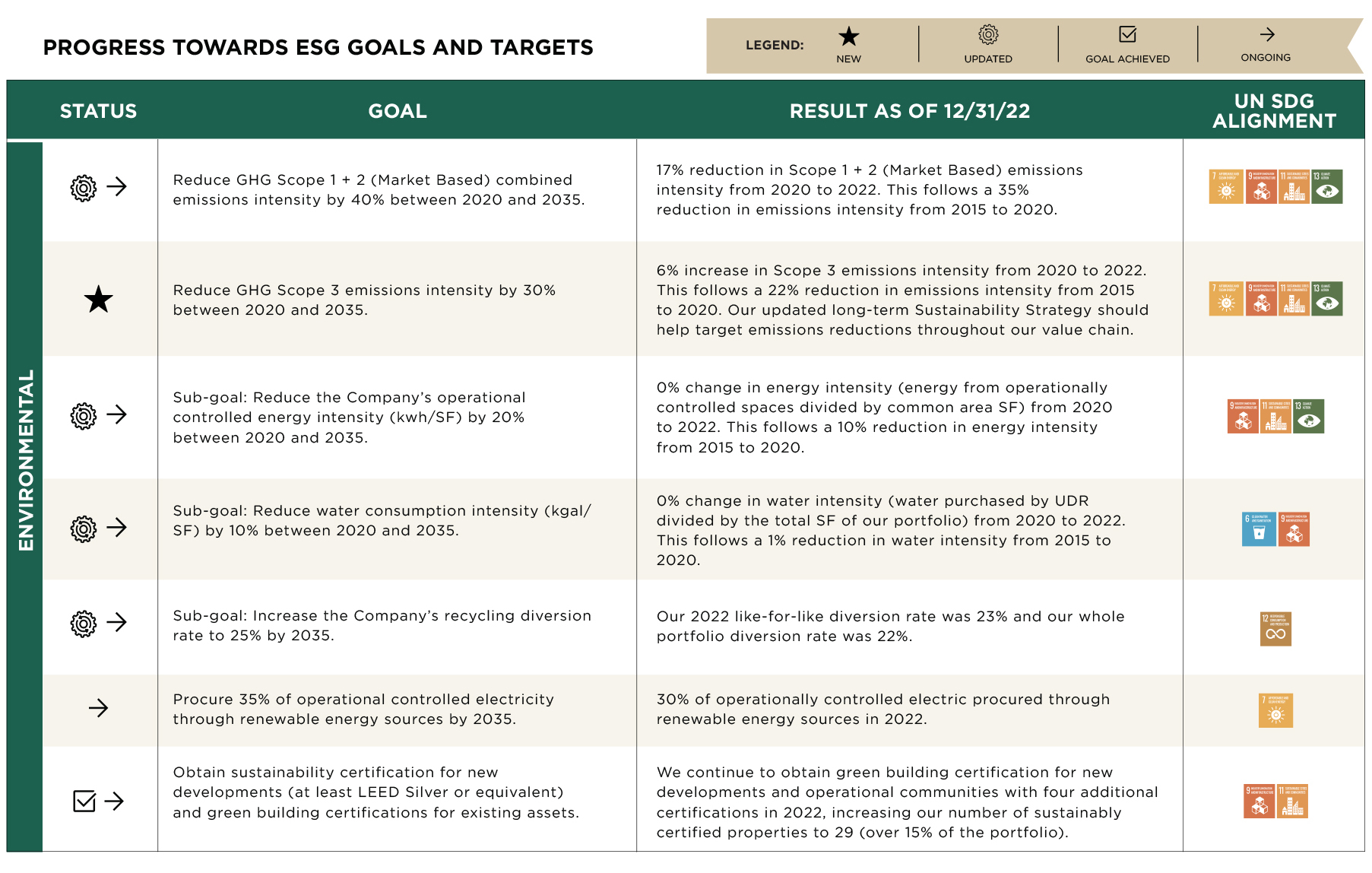

In 2023, we updated our long-term Sustainability Strategy, and adopted science-based Scope 1, 2 and 3 GHG emissions intensity reduction targets, whereby we are committing to a Scope 1 and 2 emissions intensity reduction of 40% and a Scope 3 emissions intensity reduction of 30% from 2020-2035.

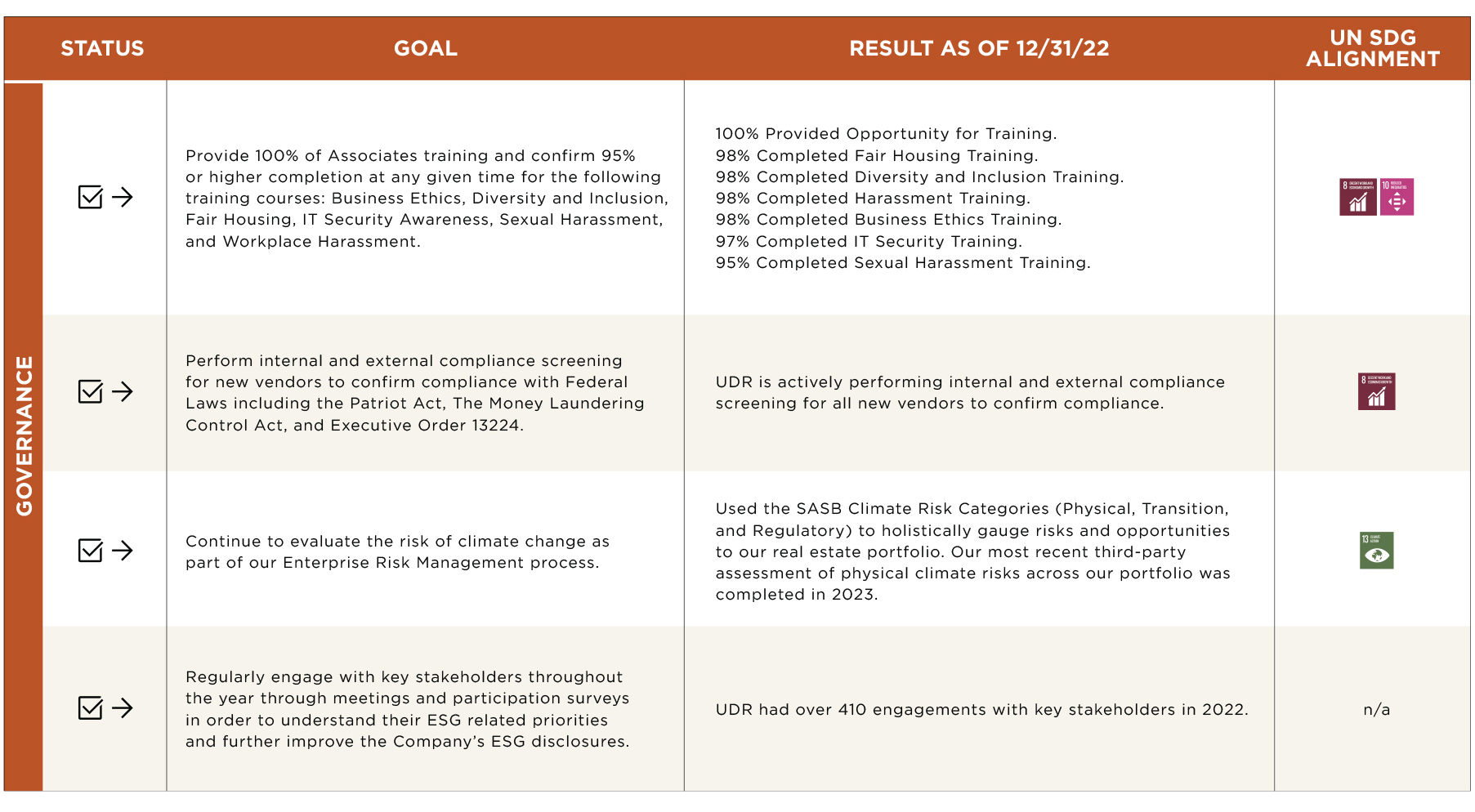

ESG Measurement and Reporting

Our ESG goals were originally established to promote sustainability across our business operations, further our inclusive and innovative culture, and create long-term value for our stakeholders. We have updated our environmental goals to align with science-based targets and to reflect our updated long-term Sustainability Strategy, including Scope 1, 2, and 3 emissions intensity reduction targets, where emissions intensity is represented as kg carbon dioxide equivalent ("CO2e") per square foot ("SF"). We continue to incorporate intensity-based energy, renewable energy procurement, water, and waste reduction goals as operating sustainably affects the carbon footprint of our entire value chain. We report our progress on each goal and target to our ESG Committee, Board, and our stakeholders. Periodically, our goals and targets are reviewed to confirm alignment with our business strategy and our stakeholders.